GiniMachine

Empower your business with GiniMachine's AI-based credit scoring and debt collection software. No coding required, streamline decision-making and optimize efficiency.

GiniMachine's Top Features

Frequently asked questions about GiniMachine

Top GiniMachine Alternatives

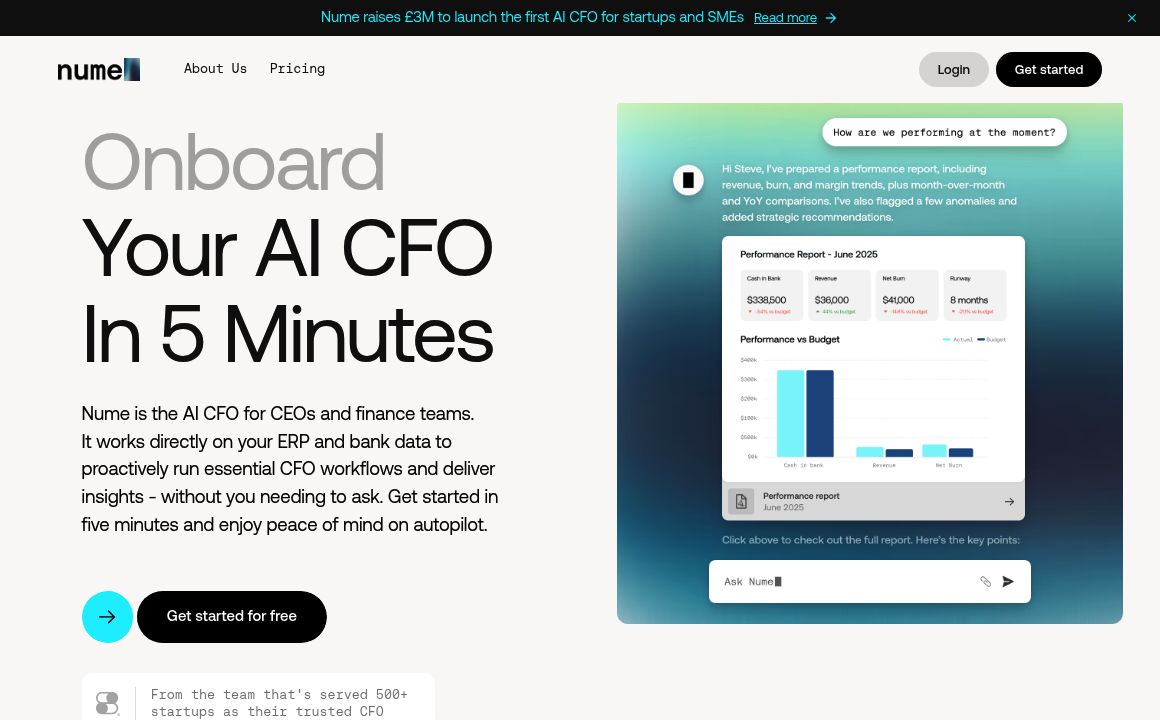

Nume

0Nume is an AI-powered financial tool for startups, offering real-time monitoring, reports, insights,...

Utilize Decode Investing's AI assistant, Saturday, to read and review earnings calls effortlessly.

Rose.ai

0Discover, visualize, and analyze data effortlessly with Rose AI, a platform designed to simplify dat...

Discover Finalle.ai, your go-to platform for AI-powered financial news and tools, designed for next-...

Discover valuable insights and streamline your stock research with GPT-powered AI features on StockI...

Discover Investor Hunter: Your go-to platform for market analysis, personalized recommendations, and...