credithq.tech

AI platform for credit scoring, underwriting, AR automation, and collections—secure, predictive, and easy to integrate.

credithq.tech's Top Features

Frequently asked questions about credithq.tech

credithq.tech's pricing

Free

$0/

- 14-day free trial; no credit card required

- Access to full core features during trial

- Sign up via dashboard to test the platform

Custom

$0/custom

- Custom, usage-based pricing (e.g., per credit decision, per API call, or per loan application)

- Flexible billing: monthly or annual commitments

- May include per-user or per-seat pricing for team access

Enterprise

$0/custom

- All features of Custom plan

- Volume-based discounts

- Dedicated account manager

Top credithq.tech Alternatives

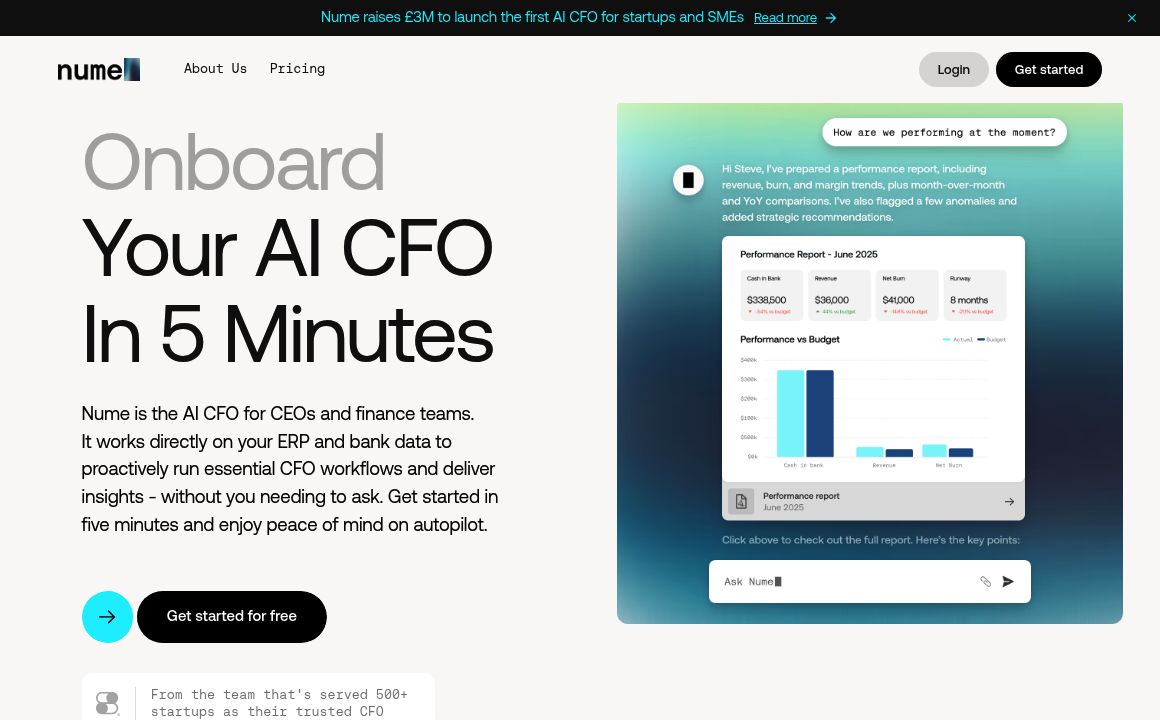

Nume

0Nume is an AI-powered financial tool for startups, offering real-time monitoring, reports, insights,...

Utilize Decode Investing's AI assistant, Saturday, to read and review earnings calls effortlessly.

Rose.ai

0Discover, visualize, and analyze data effortlessly with Rose AI, a platform designed to simplify dat...

Discover Finalle.ai, your go-to platform for AI-powered financial news and tools, designed for next-...

Discover valuable insights and streamline your stock research with GPT-powered AI features on StockI...

Discover Investor Hunter: Your go-to platform for market analysis, personalized recommendations, and...